On June 17th, the Federal Housing Finance Agency (FHFA) announced that Fannie Mae and Freddie Mac are prolonging their moratorium on foreclosures and evictions until August 31st, 2020. For real estate investors looking to add more foreclosure properties to their portfolio, this might mean an adjustment to how they navigate their future investments. What does this mean for you?

An expected drop in available foreclosures

This foreclosure moratorium is an opportunity to diversify your investment strategy and begin looking at properties at different stages of their lifecycle. One good example are bank-owned properties, they’re foreclosed homes that become the bank’s property after failing to sell at a foreclosure auction. Bank-owned property auctions typically happen online and are often sold as-is by banks in a last-ditch effort to recoup losses from a foreclosure.

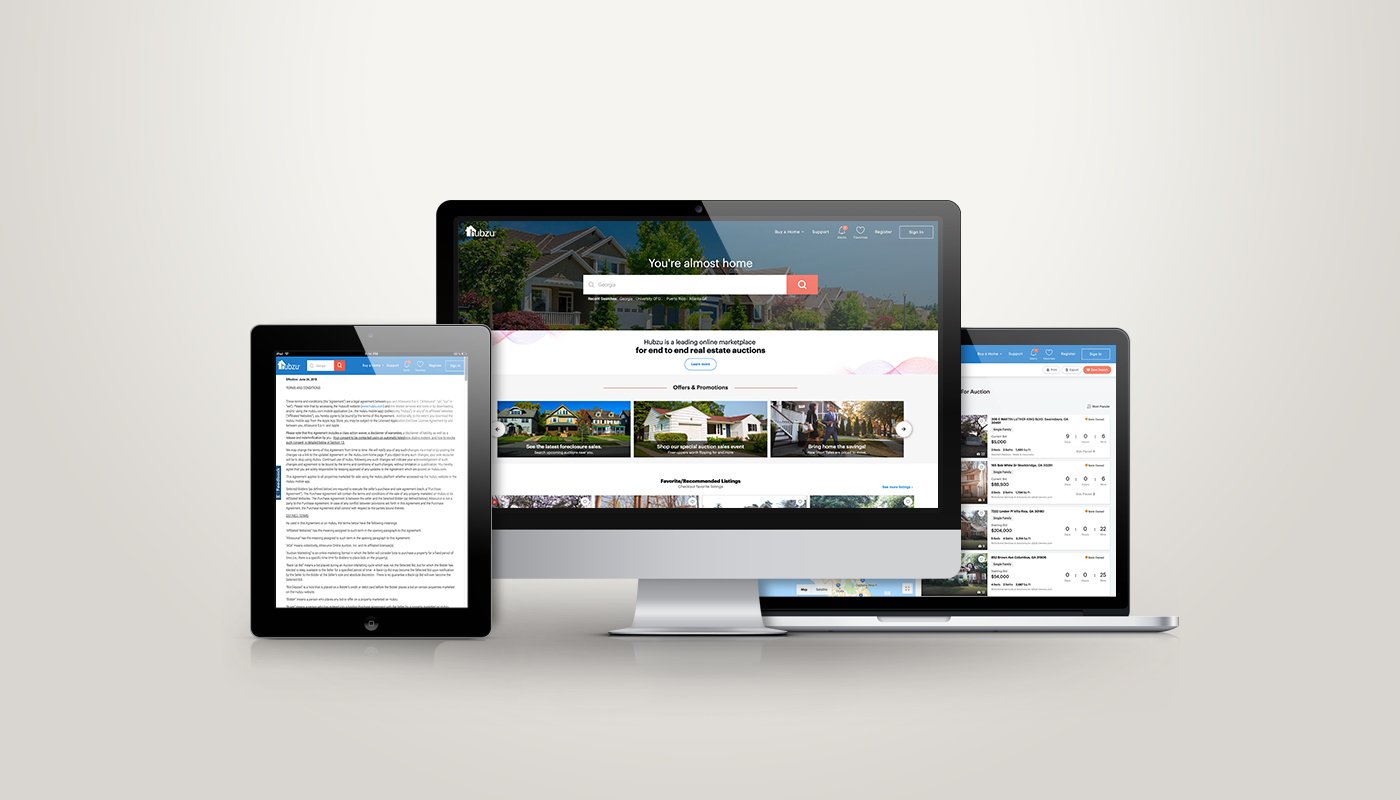

The bank is responsible for performing maintenance on the home as well as paying the property taxes. This often causes the property to become a drain of resources for the bank, which motivates them to sell the property as soon as they can. Due to their motivation to sell, these properties can sometimes be purchased at great prices. To see bank-owned properties near you, visit Hubzu now to start searching.

The foreclosure moratorium extension shouldn’t halt your property search

The temporary foreclosure moratorium doesn’t mean investors must hold off on expanding and growing their real estate portfolios. The availability of bank-owned properties can help fill the void left by the temporary lack of new foreclosures. Keep in mind that this foreclosure moratorium isn’t permanent and new foreclosures are expected to return to the housing market sometime after August 31st.

As always, stay tuned to Hubzu’s blog for information regarding the extension of the foreclosure moratorium.

For additional resources to help you navigate the current real estate market, please visit our COVID-19 resource hub by clicking here.