At Hubzu, we believe essential property information should never be shrouded in mystery. That's why we try to provide you with information available to us. You can find likely occupancy status, RentRange® Reports and other information on the property details page. We share our knowledge with you.

Keep in mind, sales are cash only purchases. It's in your best interest to prepare for auction day by having as much money as you're willing to spend available. Check state and local laws to see what is accepted during the transaction.

Who knows? You might pick up a property for a fraction of its resale value.

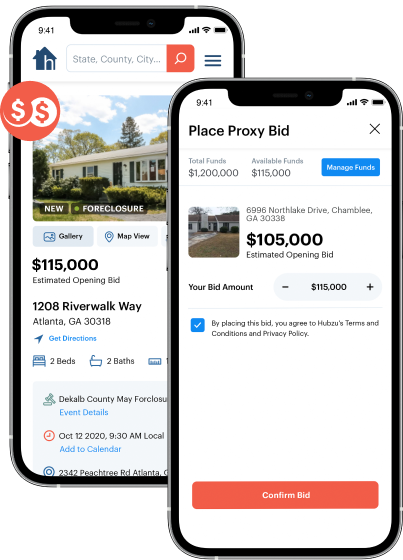

For in-person auctions, remember to double-check the property status before the auction. The foreclosure auction could be canceled or postponed. Once you have confirmed everything is a go, aim to check in at the auction location at least one hour in advance. Prepare to see hundreds of investors bidding on several properties at a time — including the one you are interested in. Interested in properties being auctioned in different locations on the same day? Looking to invest in another city, county, or state? Not able to attend the auction in person? Hubzu's new proxy bidding service lets you bid like you are there. Click the button below to learn how proxy bidding with Hubzu works.

For online auctions, make sure to register for your free Hubzu account with enough time. When the scheduled auction starts, bidding is as easy as clicking Place Bid on the property details page. Whether in person or online, once the bidding starts, don't hesitate to bid your desired amount. Auctioneers (and investors) move quickly at these events! For online auctions, you also have the ability to auto-bid. Take advantage of this feature so you don't miss out on the property you want.

Depending on the state, payment is either due immediately, the following day or within 30 days after the court approves the sale. You will be given instructions on how to proceed if you are the highest bidder. If you proxy bid with Hubzu, the funds needed at the end of the auction will automatically be transferred from your Hubzu wallet to the Attorney or Trustee.

The Trustee/Attorney will file the sale with the county recorder and the winning bidder will receive the property deed in the mail. This process may vary by state. Please make sure you understand and are aware of your state's requirements and process. You can find auction information and instructions on the property details page.

Foreclosure FAQs

What is a foreclosure auction?

A foreclosure auction is a time-limited bidding event conducted online or in-person with the objective of selling a property after a creditor or lienholder has obtained a judgment from a court because the owner or borrower defaulted on their loan obligations or was severely delinquent on property tax payments. In-person foreclosure auctions typically occur at the courthouse in the county where the property is located while online foreclosure auctions are virtual and conducted digitally.

When and where do foreclosure sales occur?

In-person foreclosure auctions typically occur at the county courthouse at a specified date and time. The auction schedules are often set based on applicable state or local laws. Online foreclosure auctions can take place at any date and time.

What if the property doesn't sell during a foreclosure auction?

All properties offered at a foreclosure auction typically sell. The bank or creditor holding the mortgage will typically submit a bid at the foreclosure auction that is up to the amount of the remaining indebtedness owed to it by the borrower. If a third-party bidder does not place a bid that is higher than the bank or creditor, then the property is sold to the bank or creditor and it becomes a Real Estate Owned (REO) property owned by the bank or creditor. If a third-party bidder outbids the bank or creditor during the auction, then that bidder is typically obligated to purchase the property and must close within a short time after the auction (the rules vary by state). If the bank or creditor becomes the owner of the property, they may elect to market it again in an online auction format on Hubzu.com.

Can I bid online?

In many cases, yes! Foreclosure auctions in select states (Ohio, Florida) are permitted online. Some states, however, only allow foreclosure auctions to be conducted in-person and those events typically occur at the county courthouse where the property is located. Oftentimes, a bank or creditor will want to promote the in-person auction online and as a result, prospective bidders can find information about those properties and the in-person auction events on Hubzu.com. However, if you cannot be in-person at the auction you may be able to take advantage of Hubzu?s proxy bidding service. Click here to learn how proxy bidding with Hubzu works. Keep in mind that if the live foreclosure auction results in the bank or creditor owning the property, they may elect to market it in an online auction format on Hubzu.com at a later time.

What do I need to take to the foreclosure auction?

Bidders should go to the auction prepared with cash or a cashier's check in case their bid is accepted. The county may require prospective bidders to verify their identity and provide proof of funds before the auction begins. Personal check, credit cards, money orders and letters of credit are typically not acceptable forms of payment. For more specific details regarding documentation for a particular auction event, please refer to documents section on the property details page.

What is the Estimated Opening Bid?

The Estimated Opening Bid is the projected opening bid amount at the foreclosure auction. The estimate is subject to change when the auction starts. The bid amount is typically determined by the balance of the outstanding loan, past-due property taxes, and other factors. The Estimated Opening Bid is usually not based on the market value of the property, but rather the amount of debt accrued on the property.

Can I inspect the property?

No. Foreclosure properties may be occupied. Prospective bidders cannot trespass on the property, disturb the occupants or contact the borrower to obtain information about the property. Available details on the property will be listed on the property details page and may possibly be obtained from public records.

Will the property be free and clear of all liens?

Some liens that exist prior to the foreclosure may remain in place after the foreclosure. Properties are sold "as is" or "where is" with faults and limitations. Prospective bidders are encouraged to conduct independent due diligence such as performing a title search or seeking outside legal advice prior to the sale.

Is there a foreclosure redemption period?

Redemption laws vary by state or locality. Please contact a real estate attorney for specific details regarding possible redemption periods in the state or county of purchase.

What happens if a foreclosure auction is cancelled or postponed?

The sale may be cancelled or postponed for a variety of reasons before the start of bidding. There is no guarantee that the sale will occur. Visit the property details page for the most up-to-date information on the auction. If a property sale is cancelled, it is possible it could be added to another auction at a later time.