First things first, create or log in to your Hubzu account — don't worry, it's free. Next, search for the right property. Simply filter by 'Short Sale' to find relevant, available properties.

Did a property catch your eye? Favorite it to receive any pertinent updates, and make a note of the auction start and end time. Our site is 24/7, but each property has its own auction timer. Pro tip: work with a local agent to evaluate all aspects of the property prior to the auction.

When it's time for the auction, start with the bid deposit. Then, place your bid, and get in on the auction! That's right, it's all online so no need to leave the house.

If you're the selected bidder, your bid will be submitted to the seller and servicer for review. Once your bid is approved, you will need to review and sign the purchase agreement. After the purchase agreement is signed by both you and the seller, the offer will be submitted for final Short Sale review by the servicer.

The servicer will then obtain any necessary investor or mortgage insurance company approvals and provide a Short Sale approval letter, which will outline the terms of the Short Sale for all parties to review.

Don't worry, we'll be here to guide you each step of the way.

Short sale FAQs

What is a short sale?

When a property is sold as a short sale, the seller's expected proceeds from the sale may fall short of the total amount owed to the mortgage lender or lien holders.

Who must approve a short sale?

Due to the shortfall between the amount owed and expected proceeds, both the seller and the mortgage lender, as well as any lien holders, must approve the sale.

Who owns a short sale property?

The current homeowner is the seller.

What is the difference between bank-owned, foreclosure and short sale properties?

Foreclosure auction properties are properties that are sold at a live public auction after the lender has gone through the necessary legal steps to engage in the sale of the property. Bank-owned properties are typically owned by a bank or other financial institution. The bank may have assumed ownership of the property after foreclosure. In a short sale, the current owner is attempting to sell the property for less than the amount they owe to the bank. The financial institution does not own the property, and the property has not been auctioned at foreclosure. Completing a short sale transaction requires the financial institution's approval.

How do I find short sales on Hubzu?

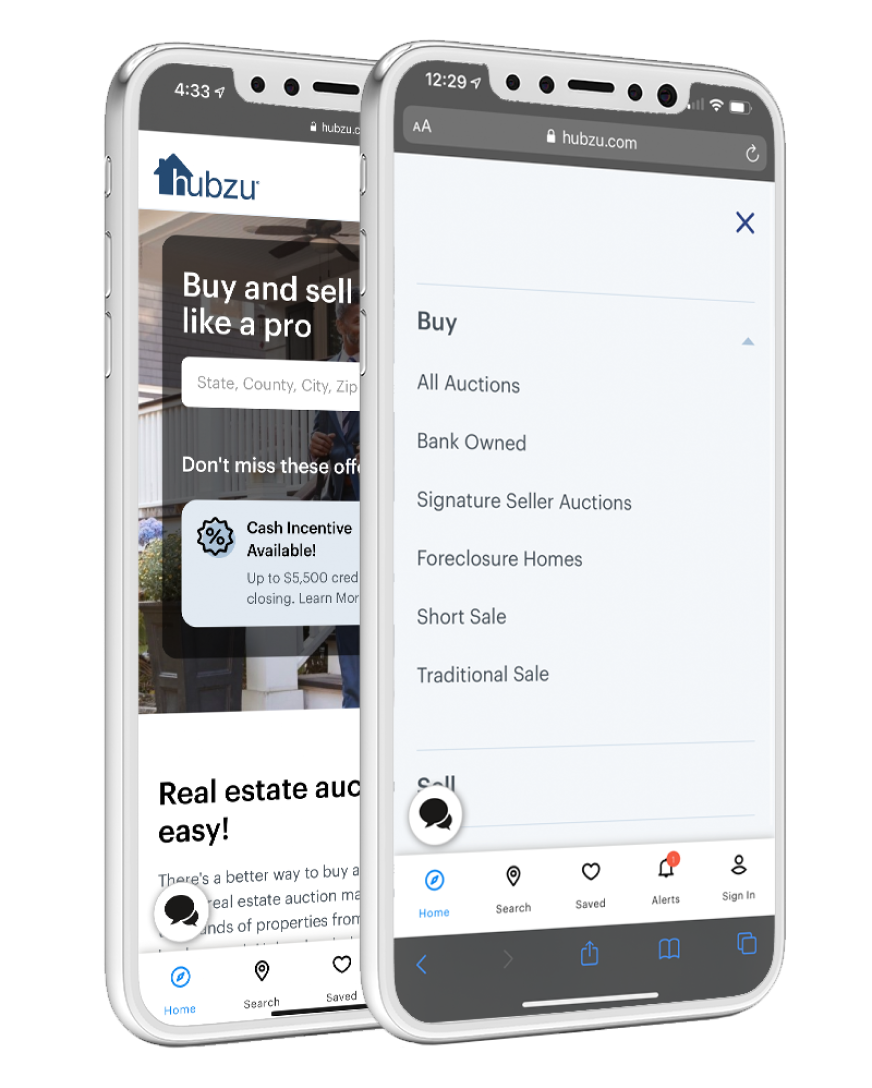

Properties on Hubzu are classified as foreclosure, bank-owned, non-bank-owned and short sale. Simply use the search filter to narrow your results to only the "short sale" listing type. Or, select "Short Sale" under the "Buy" option in the main navigation.

What is the Assisted Short Sale Program?

The Altisource® Assisted Short Sale Program offers support to financial institutions during the short sale process, which includes marketing the property on the Hubzu website.

What are the benefits of the Assisted Short Sale Program?

The program is designed to increase the likelihood of a successful sale and shorten the overall sales time by increasing marketing exposure and a range of other services. This program also provides the necessary due diligence and ability to better assess the competitiveness of the offer.

What is the Purchase and Sale Agreement Addendum?

The Purchase and Sale Agreement Addendum is an additional document required for short sales. This document will be populated with the appropriate pricing information and terms for the short sale. The Purchase and Sale Agreement Addendum must be executed by both the buyer and seller and submitted to the document processor with the executed Purchase and Sale Agreement.

Do I still get my commission if I sell a property through the Assisted Short Sale Program?

Agents who are part of an arm's length transaction with the seller will receive their commission upon the successful sale of the property. Homeowners representing themselves in the transaction are ineligible for any commission. Agents representing both the buyer and seller in the sales transaction may only be eligible for a portion of total commissions. All commissions are subject to lender's final approval.

Does the buyer or seller pay any additional fees as part of the Assisted Short Sale Program?

The selected bidder will be charged the Hubzu Buyer's Premium or a Technology Fee. There are no additional fees from Hubzu to the seller during a short sale transaction.

What documents are required for my Assisted Short Sale bid?

If the bid is for a property that's part of our Altisource® Assisted Short Sale program, the highest bidder must provide to the listing agent the following documents: 1. A Purchase and Sale Agreement (PSA) signed by the buyer 2. A PSA Addendum signed by the buyer* 3. A Preliminary HUD-1 Statement** *The PSA Addendum will be sent to both the listing agent and buyer's agent to be signed. After the seller has signed the PSA and PSA Addendum, the listing agent will send these four documents to Altisource. Altisource then submits these documents to the lender for approval.